| Benefits of having a “Trust” |

| Confidentiality |

| Assets are held in the trustee’s name, therefore the identity and interests of the beneficiaries are kept confidential continuously until the trust terminates. |

| Tax Planning |

| A trust must be used to reduce tax liabilities. Assets owned by a trust will not be dealt with in the estate of a deceased person. Hence, estate or inheritance tax may be minimised or eliminated. |

| Asset Protection |

| A trust may protect assets from claims of future creditors to the extent permitted by law. |

| Succession Planning |

| Trusts are effective tools for succession planning. They enable you to make provision for your family members, relatives and friends, charities and other organisations in the way you desire. Hence, they allow flexibility in situations where domestic inheritance rules may otherwise be imposed. They also enable efficient distribution of trust assets to beneficiaries, without consuming the time and money associated with lengthy and complicated procedures and formalities required for probate. |

| Asset Consolidation and Management |

| Trusts are a convenient means of placing your worldwide assets in one holding vehicle, simplifying both asset management and centralised financial reporting. |

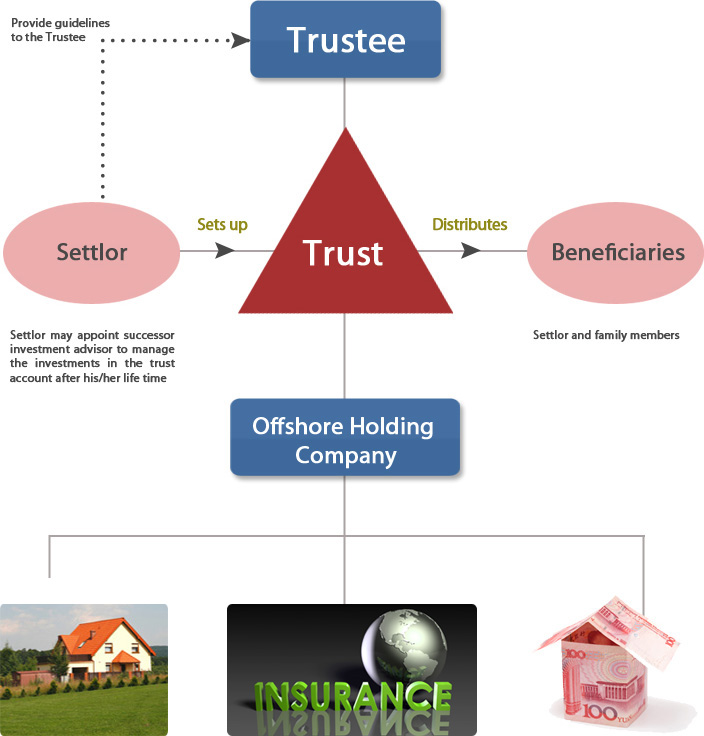

| Typical Trust Structure |

|